Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends.

In the latest UK Report on Jobs, the REC, KPMG, and IHS Markit recorded that candidate supply rises sharply amid hiring slowdown and permanent placements fall, however, temp billings growth remains mild.

Commenting on the latest survey results, Claire Warnes, Head of Education, Skills and Productivity at KPMG UK, said:

“The sharp upturn in candidate availability this month – the highest for two and a half years – is a big concern for the economy reflecting the effects of a sustained slowdown in recruitment along with increasing redundancies across many sectors.

“Employers are also tending towards temporary hires, given lingering economic uncertainty. And yet, the labour market remains reasonably resilient, with notable demand for skilled workers, both permanent and temporary, across a multitude of sectors this month.

“The evident mismatch between open vacancies and the skills of available candidates needs to be addressed urgently and a concerted focus on upskilling and reskilling is long overdue.”

Neil Carberry, Chief Executive of the REC, said:

“There is a risk of seeing an element of Groundhog Day in June hiring, with permanent billing easing again and firms still turning to temporary staff in the face of uncertainty. But there was quite a lot of change in the shadows of the headline data. There was a significant step up in the number of candidates looking for a new permanent or temporary role. This is likely driven by people reacting to high inflation by stepping up their job search, and by some firms reshaping their businesses in a period of low growth. It’s no surprise, therefore that the rate at which wages are rising has dropped again.

“Despite these trends, the labour market remains very tight. There are still broad skills shortages, with accountancy, construction, teaching and nursing among those sectors struggling to find and retain workers. This is despite the supply of candidates across the job market having risen for four consecutive months. Earlier this month, the government published its first ever NHS Workforce Plan, which acknowledges significant staffing issues while not getting to grips with the NHS being really bad at building partnerships with staffing partners such as agencies.

“The growth in vacancies for temps and permanent staff in hotel & catering and blue-collar jobs, and for temp positions in retail, suggest businesses anticipate that people are still prepared to spend their wages on goods and services despite the fall in their purchasing power and the wider cost-of-living crisis. This is backed by anecdotes from REC members noting that the warm weather in June was a significant driver of demand.

“Long-term progress rests on the UK being a great place to invest. A strong industrial strategy with people at its heart would help overcome labour and skills shortages, acknowledging the wide range of choices that people have about how they work. Progress should start with action on skills and immigration, but also accelerating steps on childcare, transport and back-to-work support, as set out in the REC’s Overcoming Shortages report.”

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for June are:

Staff recruitment held back by lingering uncertainty over the outlook

Recruitment consultancies indicated that companies continued to hesitate to take on additional staff in June, as uncertainty over the economic outlook weighed on hiring decisions across the UK. The latest survey data pointed to a solid fall in permanent staff appointments in June, albeit with the pace of contraction easing from May’s near two-and-a-half-year record. At the same time, temp billings growth picked up slightly from May’s recent low but remained mild overall.

Candidate supply rises rapidly in June

The hiring slowdown and company layoffs impacted staff availability, which rose for the fourth straight month in June. Moreover, the latest upturn in overall candidate numbers was the sharpest recorded since December 2020, with both permanent and temporary staff supply expanding at accelerated rates.

Starting pay increases at softest rate since April 2021

Latest data revealed further marked increases in both starting salaries and temp pay at the end of the second quarter. Panel members frequently mentioned that the rising cost of living and competition for skilled staff had pushed up starting salaries and temp wages. That said, remuneration for both permanent and temporary staff rose at the slowest rates for over two years in June.

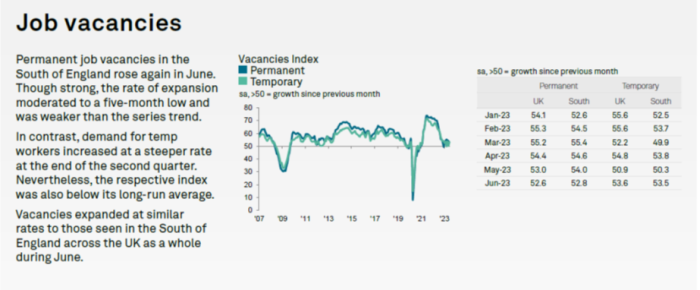

Vacancy growth eases to 28-month low

Overall vacancies continued to rise in June, but the pace of expansion softened for the fourth month in a row. Furthermore, the rate of growth was the softest recorded since the current sequence of rising staff demand began in March 2021. Underlying data indicated that a slower uptick in permanent vacancies offset a quicker rise in demand for short-term staff.

Spotlight on the South of England

Staff availability

Sharpest rise in permanent labour supply since end of 2020

Latest data revealed that the number of candidates available for permanent jobs in the South of England increased at a sharp and accelerated rate in June. Furthermore, the pace of expansion was the steepest recorded for two-and-a-half years. The upturn was also slightly faster than that seen across the UK as a whole. Redundancies were cited as a key reason pushing up candidate numbers, while some recruiters mentioned more people were willing to seek new roles.

Availability of temp candidates improves sharply

The availability of temporary candidates in the South of England increased for the second straight month in June. The rate of growth quickened notably on the month and was the sharpest seen since December 2020. That said, the net gain was the softest seen of all four monitored English regions. Higher temp labour supply was often linked to lower activity levels at clients and more people looking for short-term roles.

Special Feature

This section features data from the Recruitment and Employment Confederation

The labour market is resilient amid employers’ concern about economic strength

Inflation, the measures to stifle it, as well as ongoing industrial action and labour shortages are making it hard for some recruiters to forecast wages for candidates and fees for clients.

This is because starting salaries have risen for permanent staff for the 28th successive month in June, with pay inflation for temps also stretching to a 28-month run, according to the latest

Report on Jobs data. And as the ONS reports that average total pay for employees (which includes bonuses) rose by 6.5% in February to April 2023, and average regular pay (excluding bonuses) rose by 7.2%. The kicker however is that after adjusting for inflation, real-term total pay fell by 2.0%, and real-term regular pay (minus any bonuses) fell by 1.3%.

More broadly, the jobs market remains reassuringly resilient despite employers’ concerns about the uncertainty and strength of the economy, which means a cautious approach to hiring. The REC’s Labour Market Tracker showed the number of active postings in the week of 29 May-4 June was 2,031,765 – which although a high amount was actually a 2.4% decrease compared to the previous week (22-28 May). But this still reflects a big increase from this time last year (1,496,157). The latest data from the ONS reveals that there were 1,051,000 vacancies in Feb-April 2023.

Overall, it remains a good time to be looking for work and to ask for more pay. We know in recent years skills and labour shortages have played into high vacancies however, it’s worth remembering that in recent times recruiters have attributed higher vacancies and job adverts to a general slowdown in hiring activity and delayed decision-making amid ongoing economic uncertainty.

Despite the somewhat contrasting economic commentary around, the Bank of England’s May 2023 Monetary Policy Report expects positive growth in the UK economy because of stronger employment growth and steady labour demand. The ONS Consumer Price Index (CPI) figures also indicated a slight cooling of inflationary pressure: CPI reduced to 8.7% in April 2023 from 10.1% in March.

The best advice is to hold tight. There are no straight lines or easy predictions when it comes to where the economy will head but it looks like our labour market resilience will remain. Employers continue to turn to temporary workers to fill skills gaps.

While some sectors are making redundancies the overall recruitment market is still finding it hard to secure top talent. This is a time when experience and scientific insights from world-class candidate assessments are needed. We are proud to offer an engaging, candidate-centric experience that digs deep to understand how the values of our

To discuss how Jo Thompson Recruitment can assist you with your resourcing needs, please email us at info@jtrltd.com or give us a call at 01635 918955 for further details.