Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. This monthly report is built upon survey data from recruitment consultancies and employers, providing valuable insights into the latest labour market trends.

The June 2025 KPMG and REC, UK Report on Jobs reveals a sharp increase in labour supply, expanding at its fastest rate since November 2020. In contrast, permanent job placements have declined at the steepest pace in 22 months, underscoring continued employer caution. Additionally, pay growth has weakened for both permanent and temporary staff, indicating a softening in labour demand.

Commenting on the latest survey results, Jon Holt, Group Chief Executive and UK Senior Partner KPMG, said:

“Ongoing geopolitical turbulence and the threat of rising costs, alongside the promise of technology efficiencies, mean companies continue to wait and see with their hiring. But where there have been recent Government commitments, such as in housebuilding and infrastructure, we are seeing a small increase in permanent vacancies in related sectors – construction and engineering – which is encouraging.

“As we head into the second half of the year, global headwinds will continue to impact the overall economic outlook, but clear priorities set out in the Industrial and Trade Strategies and growth in the services sector should provide some of that confidence business leaders need to start planning future investments and to consider their hiring activities.”

Commenting, Neil Carberry, REC Chief Executive, said:

“There is more volatility month by month in the jobs market right now, as employers assess a complex picture and hire when they need to, but not yet at the rate they might want to. Much of that hesitation stems from the scar tissue left by the Spring tax hikes and fear of further business tax rises. But underlying this, there are some signs of improving demand. Temporary vacancies, especially in the private sector, are resilient. And we are seeing more sectors adding vacancies in construction, logistics, engineering and healthcare. There is potential out there – if businesses are given a clear run at doing what they do best.

“Clarity and transparency from government is vital to build trust with business and drive recovery. The new roadmap for the Employment Rights Bill allows for full and frank consultation on how the new rules will be shaped and gives breathing space to embattled businesses. Updating workplace protections is important, but striking the right balance with the business growth ambitions is the crucial part.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Executive Summary

The main findings for June are:

Steeper reduction in recruitment activity in June

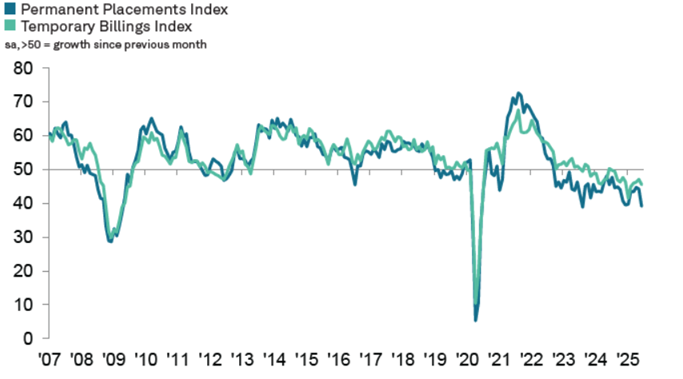

The latest survey of recruitment consultancies signalled an accelerated decline in hiring activity across the UK at the end of the second quarter. Permanent staff appointments fell at a substantial pace that was the quickest in nearly two years, while temp billings decreased at the fastest rate since February. There were

widespread reports that companies had pulled back on hiring due to reduced confidence around the outlook and worries over costs.

Candidate supply expands at fastest pace since late 2020

The overall availability of staff increased rapidly in June amid reports of redundancies and weaker demand for workers. While the supply of permanent labour expanded at a slightly faster rate than that seen for temporary candidates, in each case the rate of growth was the sharpest recorded since November 2020.

Steeper decline in overall vacancies signalled

Total demand for workers continued to decline during June, and at a quicker pace than in May. Underlying data indicated that this reflected a steeper reduction in permanent vacancies, as demand for short-term staff fell at the softest rate in ten months.

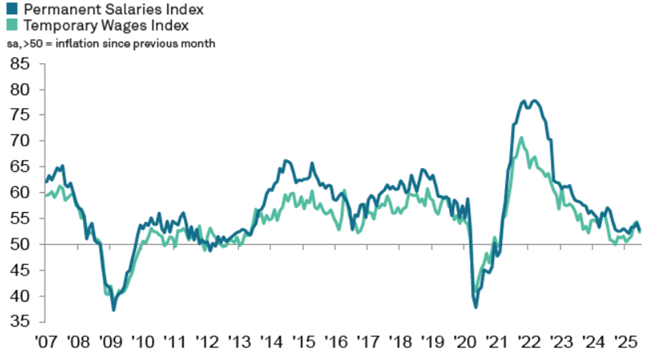

Slower growth in starting salaries and temp wages

Lower demand for workers, tighter client budgets and improvements in candidate supply dampened pay growth in June. Starting salaries and temp wages both increased modestly overall, with rates of inflation notably weaker than their historical trends.

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

KPMG and REC, UK Report on Jobs: South of England

Candidate availability increases at quickest rate since November 2020

The labour market is experiencing notable shifts as a rapid increase in the supply of workers coincides with reports of redundancies across various sectors. This rise in available labour has been accompanied by a sharp decline in both permanent placements and temporary billings, signalling a widespread reduction in hiring activity. At the same time, pay growth has slowed, reflecting a continued weakening in demand for staff and heightened competition among job seekers.

Commenting on the latest survey results Steve Hickman, Reading Office Senior Partner at KPMG UK, said:

“June saw very little positive change in hiring activity across the South of England. For the third month in a row, it recorded the steepest decline in permanent hires of all monitored regions – evidence that businesses are holding back on recruitment amid ongoing economic uncertainty.

“Meanwhile, redundancies and reduced job opportunities have expanded the talent pool at the fastest rate since late 2020, and in turn, eased some of the upward pressure on pay, softening salary inflation as demand decreases.

“Ultimately, South East businesses should not be put off from hiring if they have the resources to do so – with a broader and more competitive talent pool available to them. What’s more, investing in the right talent now could be instrumental to resilience and growth once economic conditions begin to stabilise.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Special Feature

This section features data from the Recruitment and Employment Confederation

Recruitment re-imagined: The promise and pitfalls of AI

A 2023 UK Government-backed survey found that 48% of British recruitment agencies now use some form of AI, up from 32% in 2021. Artificial intelligence (AI) is no longer experimental in the recruitment sector; it is an everyday business tool.

The Recruitment and Employment Confederation (REC) reports that the industry’s headcount grew by just 1.9% in 2023, this is far slower than the 18.6% growth the year before. As a result, agencies are turning to AI to drive productivity. One in four firms not yet using AI say they plan to adopt it within a year.

Recruitment activity continued to soften in June. The latest KPMG and REC UK Report on Jobs showed a quicker decline in overall demand for staff, driven by a steeper drop in permanent vacancies. However, demand for temporary workers fell at the slowest rate in ten months.

Why agencies are turning to AI.

Commercial pressures are also accelerating uptake. Faced with increasing levels of red tape, rising costs, shrinking margins, and widening skills gaps, agencies see AI as a faster, more efficient way to operate, offering a welcome boost in today’s challenging environment.

We see this as a global trend, too. Gallup’s latest Workforce Study reports that 93% of Fortune 500 chief HR Officers have begun integrating AI into recruitment and broader people management. These innovations can reduce time to hire by weeks, even days while surfacing passive candidates who might otherwise have been missed.

Limitations and risks: Bias, regulation and human judgement.

Despite its advantages, AI has limits. The REC’s 2023/24 Industry Status Report found that AI’s impact is strongest at the start of the recruitment process.

• 90% of agencies using AI deploy it to draft job descriptions

• 39% use it for CV screening

• 32% for proactive talent sourcing

Adoption drops significantly further down the funnel:

• Just 11% use AI to schedule interviews

• Only 8% trust it to manage onboarding

This reflects ongoing caution around automating candidate-facing tasks that require empathy and nuance.

Bias remains a concern. Former Welsh Secretary David T. C. Davies reported being repeatedly screened out by automated systems even though his CV listed a former Prime Minister as a personal reference. Despite two decades in public office, the algorithms failed to recognise the credibility of his background, illustrating how rigid systems can penalise non-standard career paths.

Beyond fairness, technical and regulatory challenges persist. AI models process huge volumes of personal data – raising potential GDPR and Equality Act compliance issues. Regulatory scrutiny will only increase as AI becomes more embedded.

The Human-AI balance: Co-pilot, not Captain.

For all its promise, AI remains “a co-pilot, not a captain.” The most effective recruitment strategies combine automation’s speed with human empathy, judgement, and relationship-building skills of consultants.

Used responsibly, AI can support faster, fairer hiring; without clear standards and oversight, however, it risks amplifying old biases. AI has the potential to reshape recruitment for the better, but in this people-centric sector, there will always be a place for people.

At Jo Thompson Recruitment, we communicate seamlessly with hiring managers, fuel collaboration by sharing information and insights. Hiring managers are time-poor, so providing pre-qualified candidates with data-driven insights and creating the resilient, agile and diverse workforce you need to succeed is a major win.

We can help you refine your data-driven recruitment strategy and tailor your approach to each target audience. Help you make informed talent decisions around diversity and hidden talent pools. To talk about how Jo Thompson Recruitment can help you with your resourcing needs, please email us at info@jtrltd.com or give us a call at 01635 734975 for more details.