Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends for the UK.

In the latest UK Report on Jobs, the REC, KPMG, and IHS Markit recorded a six-month high in temp billings growth and a marginal fall in permanent staff appointments. Staff availability rises for first time since February 2021

Commenting on the latest survey results, Claire Warnes, Partner, Skills and Productivity at KPMG UK, said:

“March was a curate’s egg for the jobs market. Candidate availability improved for the first time in over two years as people regained the confidence to look for new roles, but economic uncertainty caused firms to make redundancies and often opt for temporary hires over permanent placements.

“This unease saw temporary billings rise at their quickest rate for six months and pay continue to increase in line with the cost of living. “While the labour market continues to show resilience, it is nowhere near pre-pandemic levels of stability. The Government’s Spring Budget included some support for workers, but it was a missed opportunity to provide much needed help for businesses to upskill their people, and to reskill those people who are economically inactive and want to return to work. Such coordinated actions are needed to fill the ever-widening skills gap.”

Neil Carberry, REC Chief Executive, said:

“Over the past few weeks, we have seen a bit more confidence among employers, and this is reflected in this latest data. While the temporary market is still growing month-on-month, the permanent market contraction has eased significantly in March. After six months of slowing activity from last summer’s peak, the market is now better described as flat than declining. This is the mark of an economy performing better than was expected at the end of last year, and means it is still a good time to be looking for work, with hospitality, healthcare, accountancy and financial roles all powering ahead.

“The big news is that candidate availability is up for the first time in more than two years. This suggests that, while the market is still tight, it should be getting gradually easier for firms to hire over the next few months. The continuing fast rate of pay growth is likely reflective of the impact of inflation on wage offers, as well as low labour supply. That means increasing pay is likely to persist, despite more people beginning to look for work.

“But this cautious optimism belies the scale of the challenge we face in tackling shortages and addressing economic inactivity. The recent Budget did call out the need to address labour market shortages, but the steps taken fell short of the more comprehensive workforce strategy that is needed if we are to avoid losing two Elizabeth Lines of growth every year from 2024. We need to put the people stuff first. Government can do more – but businesses too need to step up, as our Overcoming Shortages report showed.”

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for March are:

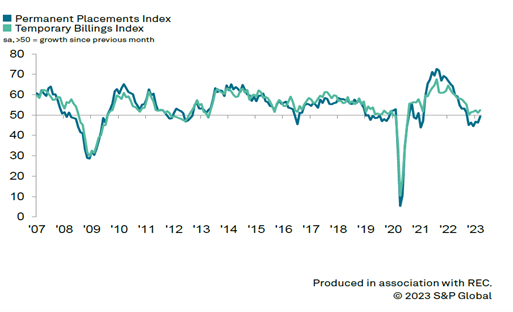

Softer fall in permanent placements, while temp billings growth accelerates

The latest survey brought signs of a relative improvement in hiring conditions during March. Although falling for the sixth month in a row, permanent placements decreased at a marginal pace that was the slowest seen over this period. There were reports of clients delaying decisions around hiring due to an uncertain economic climate and tighter budgets. At the same time, temp billings rose at the quickest rate since September 2022.

Candidate availability rises for first time in 25 months

The overall supply of workers increased for the first time since February 2021 at the end of the first quarter. The upturn was supported by modest rises in both permanent and temporary staff availability. A number of recruiters mentioned that a relative improvement in confidence among job seekers had helped to drive the uptick in candidate numbers, though redundancies were also cited as having increased staff supply.

Starting salary inflation remains sharp in March

Recruiters across the UK noted further increases in starting pay for permanent workers during March. Although edging down to the second-slowest for nearly two years, the rate of salary inflation was comfortably above the series average. Temp pay rates likewise rose sharply, albeit with growth easing fractionally to a three-month low. Higher salaries and wages were frequently linked to shortages of specific skills and cost-of-living pressures.

Demand for staff continues to increase

March survey data pointed to a further marked increase in total vacancies, though the rate of growth eased slightly from February’s four-month high. While the number of permanent roles expanded sharply, growth in temp vacancies moderated to a 26-month low in March.

Focus on the South of England permanent staff appointments increase for first time in seven months

In the latest UK Report on Jobs, the REC, KPMG, and IHS Markit recorded a modest rise in permanent placements and a fresh upturn in permanent candidate supply. Pay pressures moderate but remain strong overall .

Commenting on the latest survey results, Ian Brokenshire, Senior Office Partner at KPMG UK in the South West, said:

“The return to growth of permanent placements in the South is a sign that business confidence in the region might be building. However as this seems to be contradictory to the national trend, until we see sustained growth in this area it remains only an indication of what businesses in the South are thinking and doing. March also saw an increase in permanent candidate supply following a lengthy period of decline, as people are becoming more confident to move jobs. This may very well be boosted by the salary inflation we have been seeing across the board over recent months. It will be interesting to see if the Government’s focus on getting people back to work, combined with the cost of living, continues to push up candidate availability over the coming months.”

Neil Carberry, REC Chief Executive, said:

“Over the past few weeks, we have seen a bit more confidence among employers. This is reflected in this latest data which shows permanent staff appointments up across the South of England and temp billings up. “After six months of slowing activity from last summer’s peak, the market is now better described as flat than declining. This is the mark of an economy performing better than was expected at the end of last year, and means it is still a good time to be looking for work.

“The continuing pay growth is likely reflective of the impact of inflation on wage offers, as well as low labour supply. That means increasing pay is likely to persist, despite an increase in permanent candidate numbers in the South of England. “But this cautious optimism belies the scale of the challenge we face in tackling shortages and addressing economic inactivity. The recent Budget did call out the need to address labour market shortages, but the steps taken fell short of the more comprehensive workforce strategy that is needed if we are to avoid losing two Elizabeth Lines of growth every year from 2024. We need to put the people stuff first. Government can do more – but businesses too need to step up, as our Overcoming Shortages report showed.”

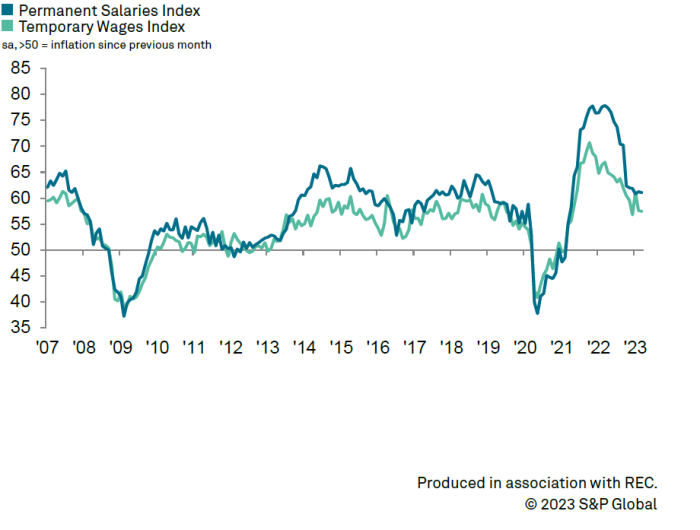

Pay pressures

The recruitment industry survey tracks both the average salaries awarded to people placed in permanent jobs each month, as well as average hourly rates of pay for temp/contract staff.

Starting salaries continue to rise at historically sharp pace

UK recruitment consultancies signalled a sustained increase in starting salaries for permanent workers in March, thereby stretching the current sequence of rising pay to just over two years. According to panel members, the latest upturn was driven by efforts to attract scarce candidates. The higher cost of living also imparted upward pressure on pay. The rate of inflation was historically sharp, albeit the second-softest for nearly two years.

All four monitored English regions noted higher starting salaries, led by the North.

Temp wage growth remains marked

Adjusted for seasonal variance, the Temporary Wages Index signalled an increase in average wages for temp staff for the twenty-fifth straight month in March. Despite edging down to a three-month low, the rate of inflation was sharp and above the series average. Where higher temp pay was recorded, recruiters often attributed this to competition for staff and the rising cost of living.

The sharpest increase in wages was seen in the North of England, and the softest in London.

Special Feature

This section features data from the Recruitment and Employment Confederation

Jobs market remains resilient as economic confidence rebounds

The official headline numbers show some progress on vacancies being filled – a step in the right direction – but there is still a long way to go to get back to pre-pandemic levels of stability and labour supply.

The latest data from the Office for National Statistics provides some good news with the employment rate in November 2022-January 2023 up by 0.1% and the economic inactivity rate was down by 0.2%. In the same period, the unemployment rate remained stable at 3.7% compared to the previous rolling quarter. Although the number of vacancies for December 2022-February 2023 decreased by 51,000 on the quarter, it is important for policymakers to appreciate that it remains at historically high levels. But the headline numbers are improving, reflecting that the jobs market has remained resilient despite an economic downturn.

To add to the positivity, REC’s latest JobsOutlook found that between December 2022-February 2023, business confidence in the UK economy continued to grow – rising by 13% on the quarter. Employers’ confidence in making hiring and investment decisions saw even more substantial growth of 16% on the quarter.

Very few organisations collate and have access to the kind of quality data on employment that REC has, and our work is vital to help inform accurate debate about the economy.Our Labour Market Tracker helps businesses and policymakers understand the latest vacancy data and its impact by region and sector. Our most recent Tracker shows the number of active postings in the week of 6-12 March 5 % higher compared to the previous week. The figure has remained around or above 1.4 million since January 2022. Certain sectors are struggling more than others for example there was a double-digit percentage rise in the past few weeks to nearly 40,000 nursery, primary and secondary job vacancies.

Another note of caution from the ONS data that the number of people who are economically inactive due to long-term sickness has risen again after a couple of months of falling.

In recent years the REC has encouraged the government to reform childcare to help parents, guardians and over 50-year-olds into the workplace. The Spring Budget started to focus on the right areas with childcare and support to work, but there is a lot to do if these plans are to really make a difference. And the implementation of the childcare changes won’t come quickly enough to help businesses and industry overcome entrenched labour shortages in the current economic slowdown.

So, although there are some bright spots in the data, governments and business need to do better for the million-plus people who are economically inactive but would like to work right now, and the million-plus who don’t want a job now but expect to work in the future.

At Jo Thompson Recruitment, we communicate seamlessly with hiring managers, fuel collaboration by sharing information and insights. Hiring managers are time-poor, so providing pre-qualified candidates with data driven insights and creating the resilient, agile and diverse workforce you need to succeed is a major win.

We can support you to refine your data-driven recruitment strategy and tailor your approach to each target audience. Help you make informed talent decisions around diversity and hidden talent pools. To discuss how Jo Thompson Recruitment can assist you with your resourcing needs, please email us at info@jtrltd.com or give us a call at 01635 918955 for further details.