Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends.

National Trends

In the latest UK Report on Jobs, the REC, KPMG, and IHS Markit recorded that permanent placements fall further, while temp billings growth eases and we see the strongest rise in candidate numbers since end of 2020.

Commenting on the latest survey results, Claire Warnes, Head of Education, Skills and Productivity at KPMG UK, said:

“The jobs market remains subdued, with the latest survey results showing dampened hiring activity amid ongoing economic concerns. Overall vacancy growth slowed for the third month as businesses delayed hiring decisions, and permanent staff appointments fell for the eighth month in a row as many employers stick to temps.

“Businesses ready to grow can feel optimistic about an increasing pool of available candidates, which has expanded at the sharpest rate in two-and-a-half years. For job seekers there was more demand for permanent workers in the healthcare, financial and accounting sectors. And while temporary vacancy growth slowed, there are still plenty of opportunities, especially in the hotel and catering industries.

“It’s a tough time for employers, and what they really need is an upskilled and reskilled workforce which can move between sectors and quickly fill their vacancies. This will in turn aid economic recovery. The Government’s new Local Skills Improvement Fund scratches the surface of the problem, but more needs to be done to urgently address the UK’s widening skills gap.”

Neil Carberry, Chief Executive of the REC, said:

“We’ve been hearing more and more about differences between sectors in hiring rates over the past few months, and today’s data really highlights this. While hospitality, healthcare and engineering remain strong, construction, IT and retail are all weakening. Despite the overall temporary work market continuing to grow – and permanent hiring declining from the sugar rush of 2022 – the story can vary widely across different businesses as their economic outlook remains unclear.

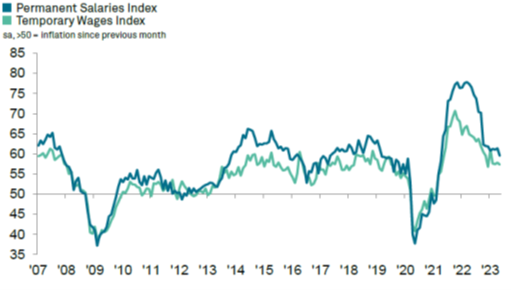

“For hiring businesses, greater candidate availability will help resolves shortages, though inflation means wage growth remains high. In addition, candidates may have to change sectors in their job search, so there is not an automatic increase in candidate supply for shortage roles. All of this puts a premium on getting our response right as businesses – looking at skills development and widening the net of places that firms look for candidates. Recruiters can help with this.

“Government can play its part, too. Proper reform of the Apprenticeship Levy to deliver more flexible and effective training options could help speed sector-to-sector transfers, as could greater use of temporary working to help candidates get a start. Regulation also needs to treat temporary work as a positive option – not a second choice.”

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for May are:

Economic uncertainty continues to dampen hiring activity

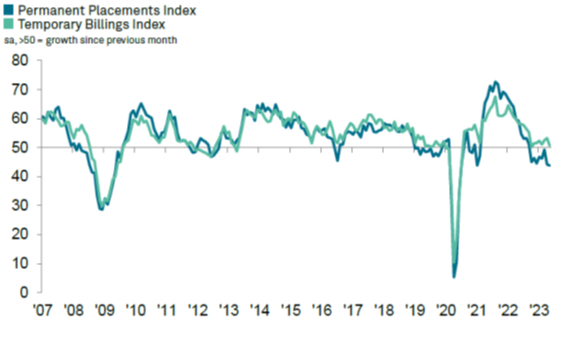

Lingering uncertainty around the economic outlook and delayed decision-making continued to weigh on staff placements midway through the second quarter. Permanent staff appointments fell for the eighth month in a row and at the quickest rate since January 2021. Temp billings meanwhile expanded at the softest pace since last October and only slightly.

Total candidate supply expands at steepest pace since December 2020

The overall availability of labour improved for the third month running in May. Furthermore, the rate of expansion was the sharpest seen for nearly two-and a-half years, with recruiters often linking the upturn to redundancies and a slowdown in hiring activity. Permanent candidate availability increased at a sharper rate than that seen for temporary staff. The former rose at the quickest rate for 29 months, while the latter recorded the strongest upturn since February 2021.

Rates of starting pay rise at softer, but still strong rates

The higher cost of living and efforts to attract skilled staff continued to place upward pressure on starting pay during May. Salaries for newly-placed permanent staff rose at a historically sharp pace overall, albeit one that was the softest seen for just over two years. Temp pay growth also edged down since April and was the second-slowest since April 2021.

Vacancies increase at slowest rate in 2023 to date

Growth of demand for staff slowed for the third straight month in May, with overall vacancies expanding at the softest pace since last December. Furthermore, the upturn was the second-weakest recorded since February 2021. Permanent vacancies increased at a faster pace than that seen for temporary roles, but rates of growth were nevertheless the slowest seen for five and 33 months respectively.

Special Feature

Employer confidence in the economy is improving

Rising employment and falling economic inactivity led to a big expansion in the UK workforce in the second quarter of 2023. The demand for labour is continuing to hold up, with high levels of vacancies and rising hiring confidence among employers. More reasons for cheer were the Bank of England reporting that Consumer Price Index (CPI) inflation is expected to fall sharply from April this year.

The REC’s Labour Market Tracker showed that there were almost 1.7 million active job adverts in the week of 17-23 April 2023. This is a 4% increase compared to the previous week (10-16 April) and 19.5% increase compared to the year before (18-24 April 2022). The figure had stayed above 1.4 million since January 2022.

The Bank of England May 2023 Monetary Policy Report echoed our own data: employment growth in Q2 2023 is stronger than expected and the unemployment rate is now projected to remain below 4% until the end of 2024. UK GDP is expected to be flat in the first half of this year but there are positive indications of underlying growth in the economy, as evidenced by stronger employment growth and steady labour demand. The Bank of England also reported that CPI inflation is expected to fall for the remainder of the year and meet the 2% target by late 2024, driven by declines in wholesale energy prices.

Reflecting the UK’s improved economic outlook, the REC’s latest JobsOutlook survey found that employers’ confidence in making hiring and investment decisions was restored to positive territory for the first time since January-March 2022 to net: +2 in February-April 2023. Business confidence in the UK economy also improved to net: -43 from net: -51. As confidence rose, employers reported that forecast demand for both permanent and temporary workers in the next three months increased to net: +18.

It is important to re-emphasise the people and skills challenges we face.

Latest data from the Office for National Statistics revealed that the employment rate in January to March 2023 remained 0.7% lower than the pre-pandemic December 2019 to February 2020 level and the number of vacancies in February to April 2023 remained 282,000 above pre-pandemic January to March 2020 levels. More worryingly, the number of people who are economically inactive due to long-term sickness rose to a record high of 2.55 million.

Familiar problems continue to put constraints on the UK’s economic growth. From skills reform to immigration to employment regulation, the REC has been urging the government to put the people stuff first as a part of a cohesive industrial strategy. Having the right labour market activation policies is crucial in helping the UK overcome labour shortages. Bringing work-finding support together with health is also important as NHS waiting lists are sky high and health related issues continue to be a big barrier to work for many. While employers’ confidence rebounds, only tackling skills shortages will help drive sustainable growth for UK businesses and the economy.

While it’s still hard to find top talent, businesses will need to ensure that their employer brands are well-represented during the hiring process, and that hiring practices are inclusive and engaging. Jo Thompson Recruitment specialises in helping organisations secure top-tier talent, combining over twenty-five years of experience with the latest scientific insights from world-class candidate assessments. We are proud to offer an engaging, candidate-centric experience that digs deep to understand how the values of our candidates and clients align.

To discuss how Jo Thompson Recruitment can assist you with your resourcing needs, please email us at info@jtrltd.com or give us a call at 01635 918955 for further details.