Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends.

In the latest UK Report on Jobs, the REC, KPMG, and IHS Markit recorded the weakest rises in permanent placements and temp billings for 19 months. Vacancies expand at slowest rate since February 2021, and candidate shortages and the cost of living pushes up rates of pay.

Commenting on the latest survey results, Claire Warnes, Head of Education, Skills and Productivity at KPMG UK, said:

“The UK jobs market remained tight in September, with candidate shortages impacting recruiters’ abilities to fill jobs. Deepening economic uncertainty has also meant that workers are choosing to stay put in current roles, rather than apply for new roles, leading to a moderation in the overall rate of vacancy growth. Some employers, even those who anticipate that the recession may be short, are taking steps now to contain costs, including hiring freezes. Those employers who continue to invest in their workforce, particularly upskilling, may find they weather the recession better and will be in a stronger position to benefit from the upturn as and when it comes.”

Neil Carberry, Chief Executive of the REC, said:

“The challenges we see in today’s data reflects the underlying shortage of Labour the UK faces. With unemployment at record lows, pay continues to rise for both temporary and permanent workers starting new jobs, and activity levels across the recruitment and staffing industry remain high. While any economic slowdown this winter will affect the market, the extent of shortages mean that hiring will remain a focus for employers. “The REC has shown that failing to address these issues could cost our economy massively in the years to come. While there is much that Government can do, like reforming the failed Apprenticeship Levy, a lot of the answers lie with hiring businesses. Firms need to work with skilled recruiters on offers that will maximise the skill base we have. There has never been a more important time for business leaders to put the people stuff first.”

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for September are:

Recruitment activity slips to 19-month low in September

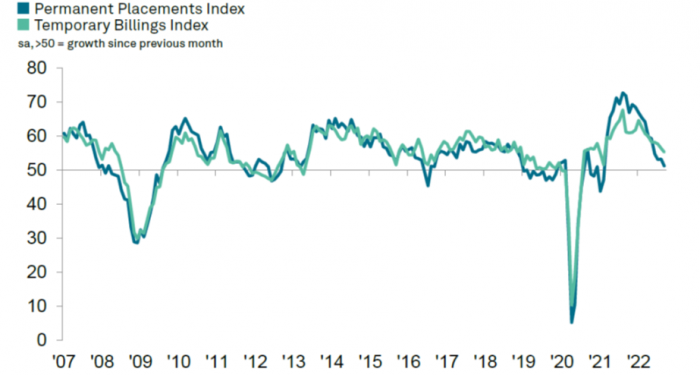

Relatively strong demand for staff and efforts to boost capacity supported a further increase in hiring activity at the end of the third quarter. However, the weaker economic climate and candidate shortages dampened overall growth. Notably, recruiters signalled the slowest increases in permanent staff appointments and temp billings for 19 months, with the former seeing only a mild expansion overall.

Growth of demand for staff weakest since February 2021

Overall vacancy growth softened for the sixth month in a row in September, to mark the slowest rise in demand for staff since February 2021. Weaker increases were signalled for both permanent and temporary vacancies, with the former noting the softer rate of expansion.

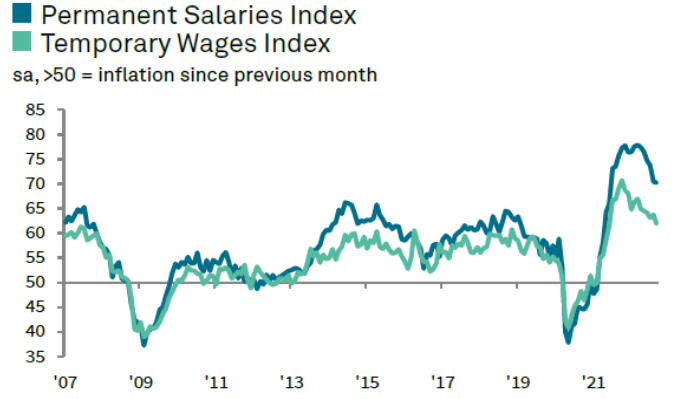

Pay pressures ease only slightly

The rising cost of living and competition for scarce workers drove further marked increases in starting pay for both permanent and short-term workers in the latest survey period. This was despite the rate of starting salary inflation moderating further from March’s all-time record to a 15-month low. Temp wage growth also edged down to its weakest since June 2021.

Candidate supply continues to fall at historically sharp pace

Although there were further signs of the downturn in labour supply easing in September, candidate numbers continued to fall sharply overall. Permanent staff availability deteriorated at a quicker pace than that seen for temp workers. A key factor weighing on candidate numbers was a greater hesitancy among people to apply for new roles, driven by fears over the economic outlook. A generally low unemployment rate, skills shortages and Brexit also weighed on candidate availability.

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Pay Pressures

The recruitment industry survey tracks both the average salaries awarded to people placed in permanent jobs each month, as well as average hourly rates of pay for temp/contract staff.

Starting pay for permanent staff rises at softer, but still rapid pace

Starting salaries for permanent workers in the UK increased for the nineteenth month running in September. The rate of inflation remained rapid, despite edging down to its lowest since June 2021. Approximately 44% of recruiters noted higher starting salaries, compared to just 2% that saw a decline, with firms often linking the upturn to greater competition for staff and the higher cost of living. On a regional basis, London saw the steepest increase in permanent pay, though rates of inflation remained sharp elsewhere.

Temp wage inflation slips to 15-month low

Candidate shortages and the rising cost of living also drove a further increase in pay for short-term staff in September. Average hourly wages have now increased in each of the past 19 months. The rate of inflation edged down to its lowest since June 2021 but remained sharp in the context of historical data. Higher temp wages were recorded across all four monitored English regions, with the South of England noting the steepest rate of inflation.

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Special Feature

This section features data from the Recruitment and Employment Confederation

Employer confidence drops, job vacancies follow suit

As we enter Q4, economic uncertainty heightens with the rising inflation and interest rates. It is no surprise to see employers’ confidence and job postings cooling-off with the current economic climate.

The REC’s latest JobsOutlook shows that in June-August 2022, business confidence in the UK economy fell by a further 9% from the previous rolling quarter. Employers’ confidence in making hiring and investment decisions also fell by 7%, the lowest figure on record since our data collection began at the start of 2022. Along with employers’ confidence, job vacancies also dropped to levels seen in the beginning of the year, according to the REC’s latest Labour Market Tracker. In the week of 19-25 September, active job adverts hit a low of 1.45 million, but this is still a high level relative to pre-pandemic, reflecting the impact of skills shortages.

Although active job postings have cooled down, employment and hours worked are still below pre-pandemic levels. Unemployment has also hit its lowest point in decades. The latest figures from the Office for National Statistics (ONS) reveal that the unemployment rate for May to July 2022 decreased by 0.2% on the quarter to 3.6%, the lowest rate since May to July 1974. This shows that employers are still hiring and the lowest unemployment rate in decades means recruitment remains significant to the UK economy.

The Office for National Statistics (ONS) also discloses that the economic inactivity rate is increased by 0.4% on the quarter to 21.7% in May to July 2022. Despite unemployment plumbing new depths, economic participation is falling, and the continued strong labour demand makes the labour market one of the tightest we’ve seen. Looking at economic inactivity by reason, the increase in the latest three-month period was driven by those who are students or having long-term sickness.

While returning the National Insurance levels and repealing the changes to IR35 will provide some relief to businesses, labour shortages and economic inactivity are still key issues that need to be tackled. Without action on productivity, higher inflation and higher interest rates will remain. This emphasises the need to attract and support people back into the labour market. Government and businesses need to collaborate to bring young people into the workforce by reforming the skills system. They also need to ensure we have an immigration system that is responsive to the needs of our economy.

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

While it’s still hard to find top talent, businesses will need to ensure that their employer brands are well-represented during the hiring process, and that hiring practices are inclusive and engaging. Jo Thompson Recruitment specialises in helping organisations secure top-tier talent, combining over twenty-five years of experience with the latest scientific insights from world-class candidate assessments. We are proud to offer an engaging, candidate-centric experience that digs deep to understand how the values of our candidates and clients align.

To discuss how Jo Thompson Recruitment can assist you with your resourcing needs, please email us at info@jtrltd.com or give us a call at 07775 673129 for further details.