Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends for the UK.

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“With very little positive news out there on the economy in recent months, and lots of speculation about the Budget, it is understandable that employers are cautious with their hiring. But despite these headwinds, our annual CEO Outlook revealed this week that chief executives are more upbeat about future growth prospects for their industry and the UK economy than might be expected. They are resilient and responding to challenges by adapting their investment strategies to focus on AI adoption, managing cyber risk and upskilling their talent.

“The jobs market has not yet turned a corner and remains tough, but we saw stabilisation in some of the numbers last month. While the public finances provide little room for manoeuvre in November, some clear signals from the Chancellor that build on business confidence will hopefully support renewed hiring as we head into 2026.”

Neil Carberry, REC Chief Executive, said:

“Recruiters have been reporting a trend towards stabilisation in the permanent job market since the summer, and today’s data back that up for September. The temporary market remains somewhat healthier, with growth in some regions. We can hope that the jobs market and the economy may be moving towards calmer waters, but falling vacancies is a reminder that what is really needed is a shot of confidence in the wider economy to get things going.

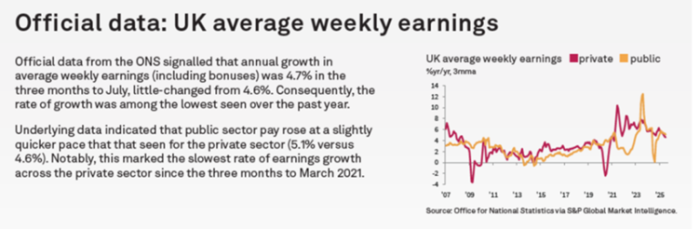

“Pay trends remain subdued where pay is set by the market rather than the Government. This suggests that pay growth should not be a drag on the Bank of England’s upcoming interest rate decision.

“The economic picture is still challenging for employers, with pressures beyond their control. A genuinely pro-business, pro-growth Autumn Budget next month could provide much-needed relief, by avoiding unaffordable tax rises on business, committing to real practicality on the Employment Rights Bill, supporting flexible work and reforming public sector hiring.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for September are:

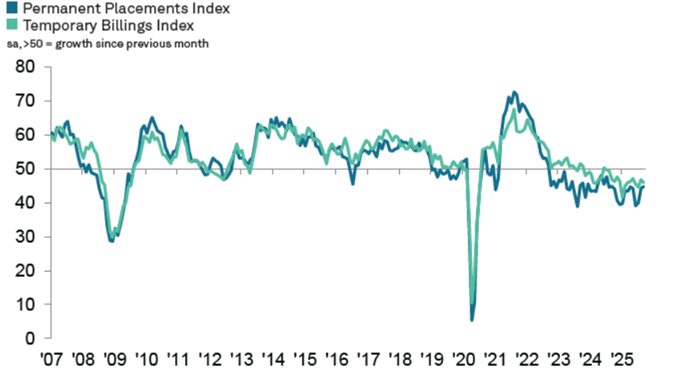

Downturn in permanent staff hiring eases in September

September survey data signalled a weaker drop in permanent staff appointments across the UK, with the latest reduction the softest seen for a year. That said, the rate of decline was sharp overall, with firms often noting that employers were hesitant to take on new workers due to weaker economic conditions and cost concerns. Temp billings meanwhile fell at a solid pace that was quicker than in August.

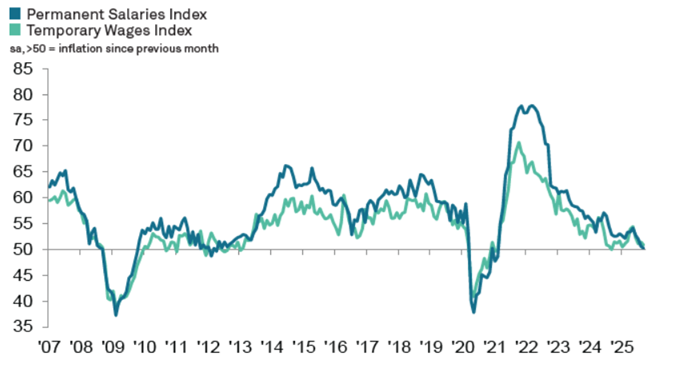

Starting salaries rise only fractionally…

Starting pay for permanent workers rose negligibly in September, with the rate of growth the weakest seen since the current run of pay inflation began just over four-and-a-half years ago. The near-stagnation of salaries coincided with reports of weaker demand for workers and reduced hiring budgets. Temp pay growth also eased in September, with wages increasing only slightly overall.

…as demand for staff falls…

Overall vacancies across the UK continued to fall markedly at the end of the third quarter. Moreover, the rate of contraction eased only slightly from August’s six-month record. Underlying data indicated that demand for permanent workers continued to decline at a steeper rate than for short-term staff.

…and candidate availability continues to rise sharply

Reduced recruitment activity and redundancies were linked by survey respondents to a further sharp increase in the availability of workers in September. This was despite the rate of expansion slowing from August’s post-pandemic record. The supply of both permanent and temporary staff increased at softer, but similarly marked rates. Accelerated fall in permanent placements signalled in December

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Pay Pressures

The recruitment industry survey tracks both the average salaries awarded to people placed in permanent jobs each month, as well as average hourly rates of pay for temp/contract staff.

Starting salaries increase only fractionally in September

Recruitment consultancies across the UK signalled that permanent starters’ salaries broadly stagnated in September. This was signalled by the respective seasonally adjusted index posting only fractionally above the neutral 50.0 value, to signal a marginal increase in pay that was the slowest since the current sequence of inflation began in March 2021. Anecdotal evidence suggested that budget constraints and reduced demand for staff had weighed on pay growth. Starting salaries rose in the Midlands and London, but fell in the North and South of England.

Temp pay growth dips to eight month low

Latest survey data signalled a further rise in average hourly pay for temporary workers across the UK at the end of the third quarter. However, the rate of wage inflation was the weakest recorded since January and only marginal. The respective seasonally adjusted index also remained well below the historical trend level of 55.2. Reports from panellists indicated that higher candidate numbers and weaker demand for staff had dampened wage growth. Solid increases in pay across the Midlands and London contrasted with declines in the North and South of England.

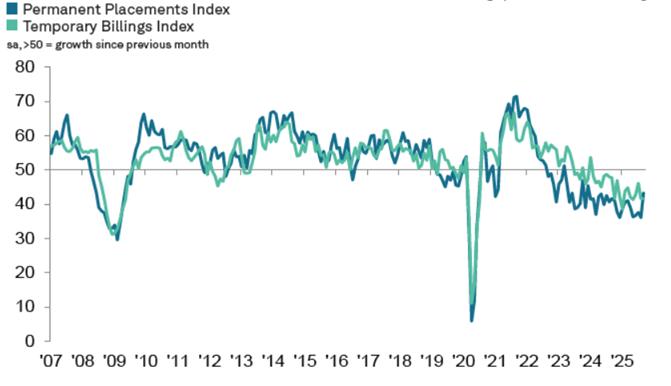

Insights for the South of England

In the latest UK Report on Jobs, the REC, KPMG, and IHS Markit have reported a softer but still notable decline in permanent staff hiring, while starting salaries and temporary wages fell at weaker rates. At the same time, the supply of temporary workers expanded at the fastest pace since the pandemic.

Commenting on the latest survey results, Steve Hickman, Reading Office Senior Partner for KPMG said:

“Recruitment activity across the South remains subdued, though September brought some tentative signs of stabilisation. Permanent hiring continued to fall, but at the slowest pace in nearly two years – evidence that employers are taking a more measured approach.

“Temporary hiring, however, is still struggling as firms hold back on short-term spending. That said, the region saw the steepest increases in candidate numbers of all UK regions, with temporary staff supply rising at the fastest rate since the pandemic. For South East businesses with the appetite to invest, this is a real opportunity to secure skills at more favourable pay levels and build stronger teams for the future.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Staff Availability

Permanent staff availability rises at slower but still rapid pace

The number of candidates available for permanent jobs in the South of England continued to increase at the end of the third quarter. The rate of expansion eased from August’s multi-year record, but remained rapid overall. Survey respondents frequently mentioned that redundancies and fewer job opportunities had pushed up candidate numbers. The South of England recorded the quickest rise in permanent staff supply of all four monitored English regions.

Temporary staff supply expands at sharpest rate since late-2020

September survey data signalled a further increase in the supply of temporary candidates across the South of England, thereby stretching the current run of growth to just under two-and-a-half years. Furthermore, the rate of expansion was the sharpest recorded since November 2020 and outpaced those seen across the three other English areas monitored by the survey. Fewer projects and company layoffs were often attributed to the latest upturn in candidate numbers.

Summary

The latest UK Report on Jobs from KPMG and the REC highlights that permanent placements fell at the slowest rate in a year, signalling tentative signs of stabilisation in the UK labour market. However, overall recruitment activity remains subdued as employers continue to act cautiously amid economic uncertainty and budget pressures. Starting salaries rose only fractionally in September, the weakest increase in over four years, reflecting reduced hiring budgets and lower demand for staff.

Temporary billings declined, and although at a slower rate, vacancies continued to fall, with permanent roles experiencing a steeper drop than temporary positions. In contrast, candidate availability rose sharply, driven by redundancies and fewer job opportunities, with temporary staff supply expanding at its fastest pace since the pandemic.

Across the South of England, permanent hiring contracted at the slowest pace in nearly two years, but temporary hiring remained weak. Notably, the region saw the steepest increase in candidate numbers of all UK regions, creating opportunities for employers ready to invest in talent at more favourable pay levels.

Looking ahead, business confidence, supported by a pro-growth Autumn Budget, will be crucial for boosting hiring momentum as the UK moves toward 2026.

To discuss how Jo Thompson Recruitment can assist you with your resourcing needs, please email us at info@jtrltd.com or give us a call at 01635 734975 for further details.