Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends.

In the latest UK Report on Jobs, the REC, KPMG, and IHS Markit recorded that permanent placements decline, but temp billings rise further. Vacancy growth picks up slightly and labour supply continues to fall, pay pressures remain.

Commenting on the latest survey results, Claire Warnes, Head of Education, Skills and Productivity at KPMG UK, said:

“January saw permanent vacancies rise at a quicker pace for the first time in nine months, with the rate of demand growth the strongest seen since last October, giving recruiters, employers and job hunters a reason to be cautiously optimistic for the year ahead. “But, with the cost of living continuing to place upwards pressure on pay, job security causing low candidate supply and employers relying on temporary staff as permanent placements decline again, the jobs market remains volatile.

“Recruiters and employers should be thinking creatively about how to attract and retain permanent hires to bring about stability, including by taking on more apprentices across a range of age groups, and investing in upskilling and reskilling their existing staff.”

Neil Carberry, Chief Executive of the REC, said:

“January’s recruitment activity suggests that speculation about a shallower economic downturn may be justified. While permanent placements dropped for the fourth straight month, the pace of contraction slowed and temporary billings growth accelerated again. The temp market had its fastest month of growth since last September. Taking into account the high level of activity last summer and autumn, when the permanent slowdown started, activity levels for both permanent and temporary roles are still high – something which is reflected both in this survey and in feedback from REC members.

“Underpinning a sense of optimism, vacancies continued to expand for both temporary and permanent roles in January. While this will reflect activity that may have been delayed from the autumn, it is another sign of firms feeling confident to hire, even if they are leaning more to temporary hiring than normal in this uncertain environment. That is the power of our temporary work market – it gives us a way to ensure firms can grow and people can build their careers even when the picture is uncertain.

“The need to address the fundamental challenges our labour market faces has not changed with the turning of the year. From skills to tackling economic inactivity, and from immigration to childcare there is much that can be done in partnership with business to help our economy grow and workers to prosper. Ahead of the Budget, the Chancellor should put the people stuff first across the whole of government. Every department has a role to play in getting growth going – and that starts with enabling our labour market.”

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for January are:

Permanent placements fall for fourth straight month

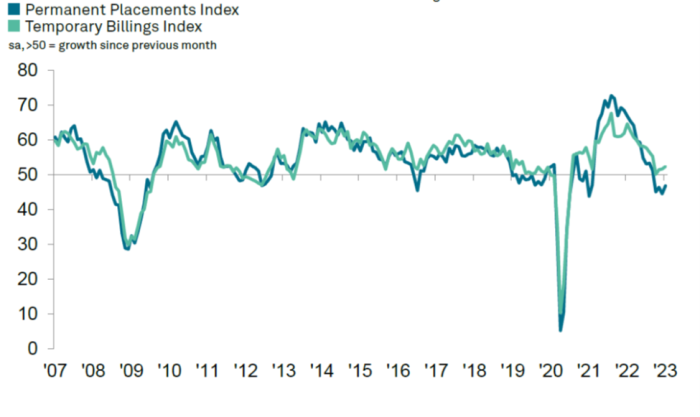

Lingering uncertainty over the economic outlook and hesitancy to commit to new permanent hires weighed on recruitment activity at the start of 2023. Permanent staff appointments fell for the fourth month in a row, albeit at the slowest rate over this period. Firms instead often leaned on temporary workers to fill vacancies. Temp billings rose at the quickest rate since last September, albeit mildly overall.

Growth of demand for staff picks up slightly

Recruiters signalled a stronger increase in demand for staff during January, with overall vacancies expanding at the quickest rate for three months. That said, the upturn remained softer than the survey’s long-run trend. Temp vacancies rose at a stronger rate than permanent staff demand, but there was an improvement in growth for the latter and a slowdown for the former.

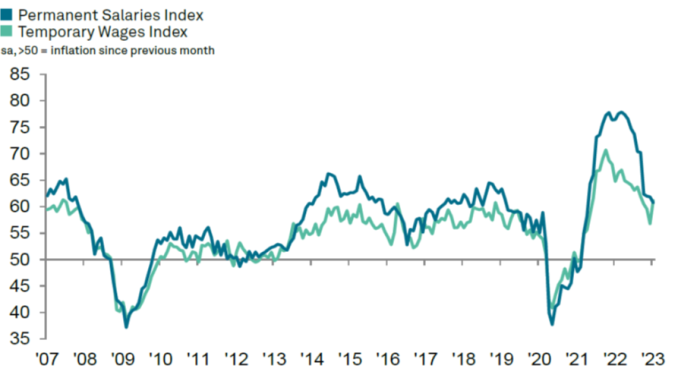

Starting pay inflation remains elevated

Starting salaries continued to climb sharply in January. The rate of inflation continued to soften from March 2022’s all-time record, however, and was the slowest seen in 21 months. In contrast, temp pay inflation quickened to a four month high at the start of the year. According to recruiters, candidate shortages pushed up rates of starting pay, while there were also mentions of the rising cost of living placing upward pressure on salaries and wages.

Overall candidate numbers fall at softer, but solid rate

The downturn in total candidate supply moderated further at the start of the year. Though solid, the rate of contraction was the softest seen since March 2021 and much slower than the average over 2022 as a whole. A weaker fall in permanent labour supply helped to offset a quicker drop in temp candidate numbers. Recruiters frequently mentioned that the uncertain economic climate, concerns over job security and generally tight labour market conditions had limited the availability of workers.

Staff Availability

Recruitment consultants are asked to report whether availability of permanent and temporary staff has changed on the previous month. An overall indicator of staff availability is also calculated.

Softest drop in labour supply since March 2021

Adjusted for seasonal influences, the Total Staff Availability Index picked up from 45.9 at the end of 2022 to 46.3 in January, to signal a solid reduction in the availability of candidates. That said, the rate of deterioration eased for

the seventh month in a row and was the least severe since March 2021. Underlying data indicated that a softer decline in permanent labour supply offset a slightly stronger fall in temp candidate numbers.

Decline in permanent candidate numbers continues to ease

As has been the case in each of the past seven months, the rate at which permanent candidate supply deteriorated eased in January. Though solid, the latest reduction was the softest seen since March 2021 and much slower than the average over 2022 as a whole. According to recruiters, fewer candidates largely reflected a more cautious attitude among workers due to concerns over job security amid the cost-of-living crisis and an uncertain economic outlook. At the same time, there were reports of redundancies helping to increase labour supply in some areas.

Only London saw an improvement in permanent candidate numbers, with falls noted elsewhere.

Slightly quicker reduction in temp staff availability

Latest survey data pointed to a sustained decline in the supply of temp workers across the UK at the start of 2023. The rate of contraction quickened slightly on the month and was solid. Nevertheless, the fall remained much softer than the average since the current period of contraction began in March 2021. A preference for permanent jobs among candidates, low availability of skilled staff and fewer foreign workers all contributed to the latest drop in temp labour supply. London was the only monitored English region to register an improvement in temp candidate numbers during January.

Special Feature

This section features data from the Recruitment and Employment Confederation

Employers continue to turn to temporary workers to fill skills gaps

Against the backdrop of double-digit inflation and soaring energy prices, economic uncertainty among businesses continues to grow. Some employers have understandably become more cautious when making hiring plans this year, but notably, vacancy levels remain historically high which means hiring especially for temps will remain strong.

The REC’s Labour Market Tracker indicates that there were 184,335 new job adverts in the first week of January this year — this is a 24.5% increase from 148,032 in the first week of January in 2022. In the same period, the number of active job postings rose to 1.53 million, suggesting that demand isn’t slowing. While some businesses are being more cautious in hiring in the face of economic uncertainty, the scale of shortages we face in our labour market means that many firms still need to hire.

According to the Office for National Statistics, the total number of vacancies remains 365,000 above the January to March 2020 pre-pandemic level. Although the economic inactivity rate decreased by 0.1% on the quarter in September to November 2022, indicating that fewer people are leaving the workforce, the high levels of vacancies still point to a tight labour market. There is a lot more to do to solve high levels of inactivity. The Chancellor Jeremy Hunt has said dealing with economic inactivity amongst older workers is something they are looking to tackle.

Although that alone won’t fix the issue. The Institute for Employment Studies writes this month, economic inactivity due to early retirement is now back to where it was before the pandemic. The challenges that we are now facing are primarily around fewer people entering work rather than more people leaving it. Skills shortages in the UK persists, and employers have continued to turn to temporary workers to meet their business needs.

As shown in the REC’s latest JobsOutlook, anticipated demand for temporary workers continues to rise. In October-December 2022, employers’ intentions to hire agency workers in the next three months rose by 4% to net: +7. Forecast demand for agency workers in the next four to 12 months also rose by 2% to net: +8. The trend for many companies to hire temporary workers continues, at a time when economic uncertainty grows and candidate supply falls short.

Temporary workers helped keep many companies in business in 2022 and continues to be the backbone of our economy in 2023. Employers’ demand for staff highlights the need to tackle labour shortages with reform across our welfare support, skills and immigration systems.

While it’s still hard to find top talent, businesses will need to ensure that their employer brands are well-represented during the hiring process, and that hiring practices are inclusive and engaging. Jo Thompson Recruitment specialises in helping organisations secure top-tier talent, combining over twenty-five years of experience with the latest scientific insights from world-class candidate assessments. We are proud to offer an engaging, candidate-centric experience that digs deep to understand how the values of our candidates and clients align.

To discuss how Jo Thompson Recruitment can assist you with your resourcing needs, please email us at info@jtrltd.com or give us a call at 01635 918955 for further details.