Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends for the UK.

In the latest UK Report on Jobs, the REC, KPMG, and IHS Markit recorded that staff placements fall again amid ongoing economic uncertainty. Starting salaries and temp wages both increase at slower rates and candidate supply rises sharply as vacancies drop at faster pace.

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“The impasse between economic uncertainty and hiring decisions continued into February. Chief Executives tell me they are ready to invest and grow – including taking on new staff – yet the reality is they’re being held back by the prospect of weak demand.

“Businesses would ideally have liked a Budget that drives investment, boosts economic growth and helps productivity bounce back. While it was encouraging to see measures to increase labour supply, there was limited headroom for change – only time will tell if the Chancellor’s announcements go far enough to shift the dial on the UK’s economic outlook.”

Neil Carberry, REC Chief Executive, said:

“As inflation is falling back to target earlier than expected, it’s time to get the focus on growth. This month’s survey shows the market slowing, and a concerning increase in the decline in temporary billings, to the lowest performance since the middle of 2020. Given recent news about GDP dropping, this overall picture is no surprise – but it is certainly still quite resilient by comparison with previous recessions. We know the economy has the potential to create jobs and opportunities – but it can only do that sustainably if we can get economic growth going.

“Following the Budget last week, which didn’t address some of the key drivers of growth like skills, infrastructure and reducing the cost of investment and employment, all eyes are on the Bank now. Lower interest rates will help build firm’s confidence to invest.

“The temporary labour market is the unsung hero of the economic uncertainty of recent years. It keeps the cogs of the economy turning amidst uncertainty and labour shortages – but it still needs nurturing. As we approach the General Election, businesses will be looking to politicians for commitment on this, and reforms of regulation that will support it from IR35, to regulating of the umbrella market and delivering flexibility to the Apprenticeship Levy.”

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for February are:

Recruitment activity continues to decline in February

The number of people placed into permanent jobs across the UK continued to decline markedly midway through the first quarter of 2024, as uncertainty over the economic outlook led employers to often delay or freeze hiring decisions, according to recruiters. At the same time, muted employer confidence and cost concerns led to the steepest reduction in temp billings since July 2020.

Permanent salary inflation eases to near three-year low

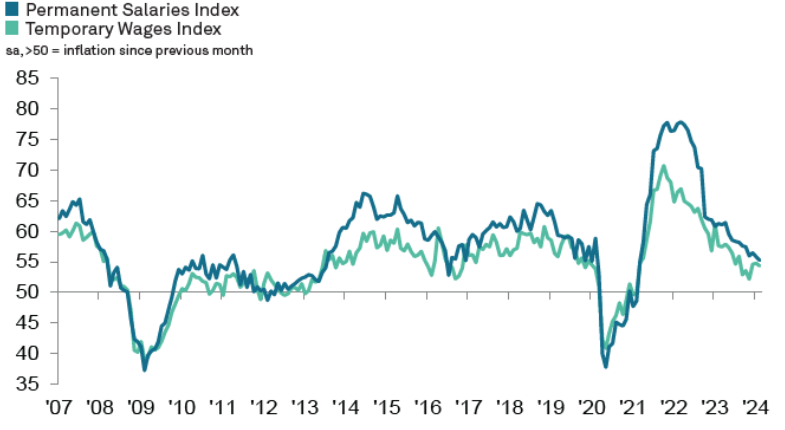

February survey data signalled further increases in rates of starting pay for both permanent and temporary workers, as employers raised rates of pay amid the higher cost of living and competition for highly-skilled candidates. However, the rate of salary inflation was the slowest recorded in nearly three years, with a number of recruiters noting that employer budgets were now tighter after a period of rapidly rising pay. Temp wage growth also moved further below the long-run trend level during February.

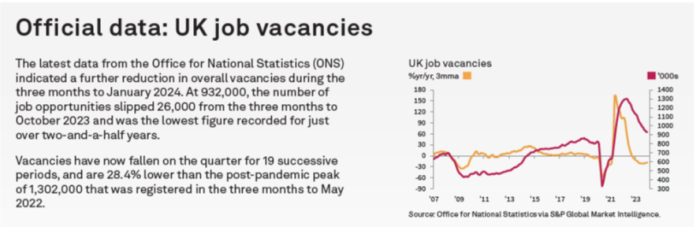

Demand for staff drops at fastest rate since January 2021

UK recruitment consultancies signalled a solid and accelerated reduction in demand for workers during February. Notably, the rate of contraction was the quickest recorded since the start of 2021, and primarily driven by a fall in permanent staff vacancies. Temporary job opportunities fell for the first time in three-and-a-half years, albeit only marginally.

Availability of workers continues to expand sharply

The availability of staff rose for the twelfth straight month in February amid reports of redundancies and a slowdown in hiring activity. Overall, labour supply expanded at a historically sharp pace, albeit one that was softer than those seen in the prior four months. Underlying data indicated that the increase in candidate availability was driven by marked upturns in both permanent and temporary candidate numbers.

Courtesy of KPMG and REC, compiled by S&P Global

Focus on the South of England

Hiring activity declines as employer confidence remains subdued in February

In the latest UK Report on Jobs, the REC, KPMG, and IHS Markit recorded a further sharp drop in permanent placements, while temp billings fall back into decline. Pay growth eases as demand for staff softens.

Commenting on the latest survey results, David Williams, KPMG UK South West Senior Partner, said:

“The decline in both permanent and temporary recruitment across the South show that the challenges facing the economy are weighing heavily on growth ambitions and the appetite to hire.

“Some sectors remain under pressure from significant labour shortages, including blue collar, professional services and IT/Computing – so there is opportunity out there for job seekers. But the report also emphasises again that sustained positivity in our labour market rests on economic growth and investment.

“Although the latest data reflects mutual hesitation from both businesses and prospective candidates, there are some green shots in the region. Notably, the most recent unemployment figures put the South West as having the second-lowest unemployment rate, at 2.8%, with only Northern Ireland having a lower rate.”

Neil Carberry, REC Chief Executive, said:

“As inflation is falling back to target earlier than expected, it’s time to get the focus on growth. This month’s survey shows the market slowing, and a concerning decline in permanent and temp staff recruitment in the South of England.

“Having said that, there is continuing demand for workers with accounting, financial, engineering and IT skills in the South of England.

“Given recent news about GDP dropping, this overall picture is no surprise – but it is certainly still quite resilient by comparison with previous recessions.

We know the economy has the potential to create jobs and opportunities – but it can only do that sustainably if we can get economic growth going.

S&P Global UK Business Outlook

These findings reveal how confident UK private sector businesses feel about their prospects for the next 12 months.

The Global Business Outlook Survey for worldwide manufacturing and services is produced by S&P Global and is based on a survey of around 12,000 manufacturers and service providers that are asked to give their thoughts on future business conditions. The reports are produced on a tri-annual basis, with data collected in February, June and October.

Key Findings

- Output expectations in the UK rise to the highest level since February 2022

- Profit, staff hiring and capex forecasts strengthen

- Projections for selling prices tick higher for the first time in two years, adding inflation risk

- Non-staff input cost expectations also pick up after period of slowing

Commenting on the findings, David Owen, Senior Economist at S&P Global Market Intelligence, said:

“The Business Outlook findings pointed to a much-improved atmosphere among UK firms in early 2024, as companies begin to look past the recent cycle of tightening financial conditions and plan for an uplift in fortunes over the coming year. Sentiment towards future activity was accordingly up sharply from 2023 levels, as were profits forecasts and capital expenditure plans, which bodes well for UK business investment. Hiring plans also grew, albeit mainly in the services sector, whereas R&D spending is likely to remain subdued.

“While growth projections improved, firms were slightly more cautious about the inflation outlook. Wage pressures are forecast to remain incredibly sticky, and transport costs could pick up amid global supply chain challenges. With this in mind, output price inflation expectations sharpened for the first time in two years, showing that firms are still wary of price pressures and therefore not ready to relax their own charges.”

Overview

UK business confidence soars to two-year high as economic concerns ease

The latest S&P Global UK Business Outlook pointed to the highest sentiment among UK companies towards future activity levels in two years.

A net balance of +49% of UK private sector companies anticipated a rise in business activity over the next 12 months, according to survey data collected between 12-27 February. This was the highest recorded since February 2022, having increased sharply from +37% last October.

Furthermore, the UK posted the strongest sentiment out of the 12 economies monitored by the survey. Ireland was the next-highest with a net balance of +43%, while Germany resided at the bottom of the rankings (+10%).

Growing confidence among private sector firms came alongside an easing of concerns about the impact of high inflation and rising interest rates on domestic economic conditions. Although elevated, worries about output being suppressed by these factors were lower than the levels seen in 2023, according to survey comments. New products, export opportunities, and the impact of technological advances such as artificial intelligence were among the reasons driving optimism.

That said, there were still many factors cited as threats to activity, such as an increase in domestic and global political uncertainty. Labour costs and skills shortages were also commonly mentioned.

Output expectations across manufacturing and services were equal in February (+49%). Services firms registered a larger improvement from the previous survey (+36% in October 2023) than goods producers (+44%).