Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends for the UK.

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“UK CEOs continue to grapple with the Bank’s hawkish stance on interest rates and will no doubt hope April’s survey data is another marker in the sand on the journey towards a summer cut.

“While there are still complexities, like pay rates improving due in part to last month’s 9.8% rise in the National Living Wage, overall pressure is easing on the labour market. Ongoing weak demand is driving the steady decline in permanent staff appointments month on month, and we’ve seen a sharp uptick in candidate availability.

“Business leaders see this cooling, combined with weakening inflationary pressure, as indicators for the Bank to hopefully shift to a more dovish position. Companies would then have the confidence and certainty to press go on their investment strategies.”

Neil Carberry, REC Chief Executive, said:

“The critical moment in any labour market slowdown is the point at which demand starts to turn around. Today’s hiring data suggests that point is close, with fewer recruitment firms reporting a drop in demand. While the trend is still gently down, the pace of decline in permanent hiring is the slowest in ten months. Temporary hiring, which has had much less of a decline overall, also scored better than last month. Firms have told us all year that they will be willing to hire and invest in their business when confidence returns to the wider economy – and there is a glimmer of lower inflation and the prospect of lower interest rates starting to drive that now.

“Pay continues to rise, with a slight bump up this month likely to have been driven by the April peak in employer pay rises and the recent Minimum Wage rise. With substantial wage rises attracting people to work, and low unemployment, businesses and government alike will need new approaches to developing and engaging our labour force – alongside new technology – if the UK is going to grow in the way it needs to.

“Our flexible labour market is at the heart of this. It is one of the big success stories of the UK economy, with millions of workers and companies building their futures in ways that would not be possible in the one-size-fits-all approach of the past. It’s why, for instance, nurses choose to work via agencies so they can get control over their working lives. Any government needs to work hard to understand what workers and companies need now – a more nuanced debate than is often centre stage in Whitehall and Westminster. A partnership approach with businesses is essential.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for April are:

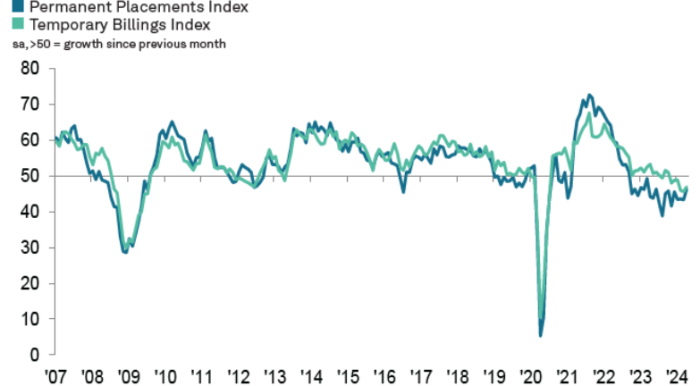

Slower falls in permanent and temporary staff appointments

There was a further fall in the number of permanent staff appointments made by UK recruitment consultants during April. Placements have now fallen in each month since October 2022, although the rate of decline in April was noticeably slower, easing to its weakest since June 2023. Temp billings also fell at a softer rate (the weakest in three months). Panellists noted continued hesitancy amongst companies in recruiting extra staff plus a lack of suitable candidates.

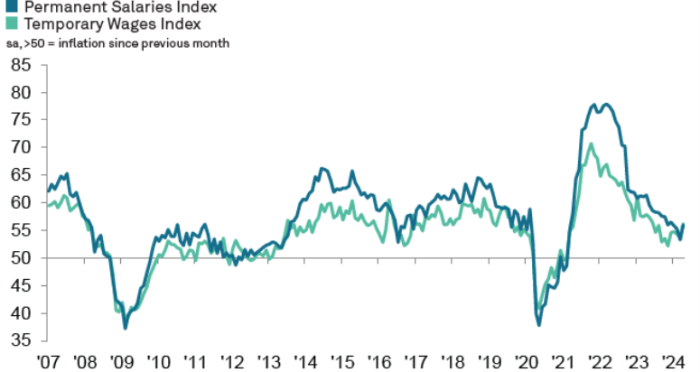

Pay rates improve in April

Pay rates picked up during April as firms remained willing to raise wages to attract suitable candidates. Latest data signalled that pay has now increased for both permanent and temporary staff for 38 months in a row. For permanent workers, the rate of growth accelerated to its highest in the year-to-date, though remained below its historical survey trend. Temporary staff saw their pay rates rise at the steepest pace since June 2023 and to a degree that was slightly above average.

Slower falls in staff demand signalled

April’s survey data showed that overall demand for staff continued to fall, extending the current downturn to six months. That said, the rate of contraction was modest and the slowest since January. Temp staff demand was down only marginally and to a slower degree than for permanent workers.

Fastest increase in staff availability since last November

Candidate availability continued to rise during April, with the rate of growth for all staff hitting its best for five months. Panellists noted a higher number of redundancies, whilst also signalling a general increase in the number of people looking for work. Rates of growth in candidate availability were similarly strong for both permanent and temporary staff.

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Pay Pressures

The recruitment industry survey tracks both the average salaries awarded to people placed in permanent jobs each month, as well as average hourly rates of pay for temp/contract staff.

Starting salaries rise at quicker pace

Permanent starting salaries continued to increase in April, extending the current period of inflation to 38 months. Moreover, the rate at which salaries rose accelerated to its highest level of the year so far (though remained below trend). Outside of the usual seasonal impacts of annual pay awards and changes in the national minimum wage, panellists commented that competition for quality candidates (who remain in short supply) had led to upward pressure on starting salaries.

Temporary wage inflation strongest for nearly a year

For temp workers, typical pay rates continued to rise in April, extending the current period of inflation to 38 months. The degree to which pay increased was also higher, picking up to its strongest since June 2023. Candidate shortages and market competition were noted in some cases to have underpinned pay inflation. By English region, the North of England experienced the fastest increase in temp pay, with London registering the slowest.

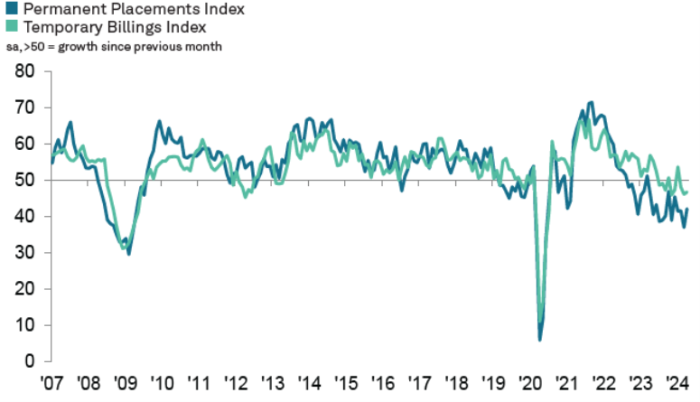

Insights for the South of England

Sustained decline in permanent placements eases across the South of England

In the latest UK Report on Jobs, the REC, KPMG, and IHS Markit recorded an ease in the downturn in permanent placements, but there remains a marked strong drop in temp billings. Pay pressures tick up.

Commenting on the latest survey results, Emma Gibson, Office Senior Partner for KPMG Reading said:

“The labour market remains challenging in April, with an increasing number of job seekers competing for fewer available roles. This slowdown in recruitment is likely due to the difficult economic climate, which has forced employers to tighten their budgets.

“Despite the overall decline in job openings, there is still a strong demand for professionals with IT and computing skills. This suggests that while the job market may be tough overall, there are still opportunities for those with specialised technical.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Staff Availability

Permanent staff supply expands at quicker and marked rate

Permanent staff supply rose at a marked and accelerated pace across the South of England in April. The rate of increase quickened for the third straight month to the fastest since last November. The upturn reflected the increased reports of redundancies. Of the four monitored regions, only London surpassed the South of England by recorded the quickest rise in permanent staff supply.

Substantial expansion in temp staff availability

Latest data revealed a substantial rise in temp candidate availability across the South of England. The rate of increase was the second fastest in the current 12-month sequence of expansion and surpassed the UK-wide average. The rise in temp staff supply was widely linked to higher reports of layoffs.

Special Feature

This section features data from the Recruitment and Employment Confederation

Job not yet done: exploring the complexities of the apprenticeship landscape

Government statistics have revealed that reported apprenticeship starts in the 2022/23 academic year are 3.5% lower than the reported starts for 2021/22. This trend has led to discussions in recent articles regarding the inconsistent and, at times, declining growth in available apprenticeships. The Times, for instance, recently posed the question: “What went wrong?” However, the narrative surrounding apprenticeships should be treated with much more nuance.

The Department for Education (DfE) has released its latest tranche of data, covering the period from August 2023 to January 2024. According to this data, there have been over 207,000 reported starts within the first six months of the 2023/24 academic year, marking a 1.5% increase compared to the same period in the previous year. While this insight provides a valuable snapshot of the apprenticeship sector’s current status, it is important to analyse how these dynamics will evolve throughout the remainder of the year to better inform organisations in guiding the next generation of employees.

Regional disparities reveal varying start rates, with the South East and North West leading in the first two quarters of the year 2023/24. However, notable discrepancies exist among regions regarding the types of apprenticeships that people pursue. For instance, intermediate apprenticeships account for 26% of total starts in Yorkshire and the Humber, as well as the South West— the highest rate among regions. Whereas, the North East has the highest percentage of Advanced Apprenticeships at 47%, compared to the national average of 43%.

Apprenticeships supported by apprenticeship levy funds constitute 63% of total starts in the first two quarters of the 2023/24 year, reflecting an increase from the previous year’s 59%. This underscores the pivotal role of the levy in funding apprenticeship initiatives and indicates what more could be achieved with a more flexible levy.

Examining apprenticeship subjects based on achievement numbers reveals that Business, Administration, and Law comprise the highest percentage of courses completed in the first two quarters of the 2023/24 year, accounting for 28.1% of the total. Health, Public Services, and Care closely follow, representing 27.1% of achievements. These two subjects collectively cover over half of all achievements, highlighting the demand for additional skilled people to address demand for these types of roles. Conversely, Education and Training account for only 2.8% of total achievements. The government’s recent expansion of free childcare at nursery level has been criticised for lack of staff to cover the increased provision. Ofsted has acknowledged that early years apprenticeships may provide a way to raise the quality and size of the early years workforce, so this area requires more specialist attention.

In summary, the apprenticeship narrative is not simply one of identifying shortcomings but rather an exploration of strategies to provide more opportunities were there is demand for skilled workers and lift the barriers to engagement with the apprenticeships system.

At Jo Thompson Recruitment, we communicate seamlessly with hiring managers, fuel collaboration by sharing information and insights. Hiring managers are time-poor, so providing pre-qualified candidates with data driven insights and creating the resilient, agile and diverse workforce you need to succeed is a major win.

We can support you to refine your data-driven recruitment strategy and tailor your approach to each target audience. Help you make informed talent decisions around diversity and hidden talent pools. To discuss how Jo Thompson Recruitment can assist you with your resourcing needs, please email us at info@jtrltd.com or call us at 01635 918955 for further details.